By Jemma Parsons, Director at The Strategy Group

At last the rolling national energy debate has landed on the relationship between retailer and consumer. As a consumer observing the national debates, I’ve rolled with the weekly gear-shifts as layers of our ailing energy system were peeled back, exposed and set ablaze.

The system-wide shake up is precisely the impetus we needed to evolve, but the current focus on the consumer is particularly pertinent. Why? Because the power, control and responsibility for generating and managing energy is fast moving into the hands of the consumer.

One of the most significant changes reshaping our energy system is the increasing capacity for households to generate energy. Average consumers will increasingly need to actively and intelligently manage generation and consumption. In turn retailers must evolve to offer consumers innovative, technology-driven products and services that allow them to do just that.

Just like every other sector and industry, the power shift away from organisations and towards consumers is transforming the energy space. The combination of technology and access to knowledge empowers consumers, and Australian retailers across the board are struggling to stay ahead of this shift.

The Future Grid Forum, convened by CSIRO, brought together more than 120 experts working across the national electricity value chain to analyse potential electricity pathways to 2050.

Its report describes the four most likely future states of the Australian energy sector. One is that by 2050 on-site generation will supply almost half of all energy consumption. Australian households and businesses will evolve to generate half of our total energy consumption through on-site use of solar, battery and other renewable technologies.

This is not just a CSIRO finding, Bloomberg New Energy Finance predicts a similar outcome – that by 2040 energy consumption would be 35 per cent on-site or “behind the meter” generated.

The implications of this shift are enormous for retailers and consumers and the relationship between the two.

New retail models

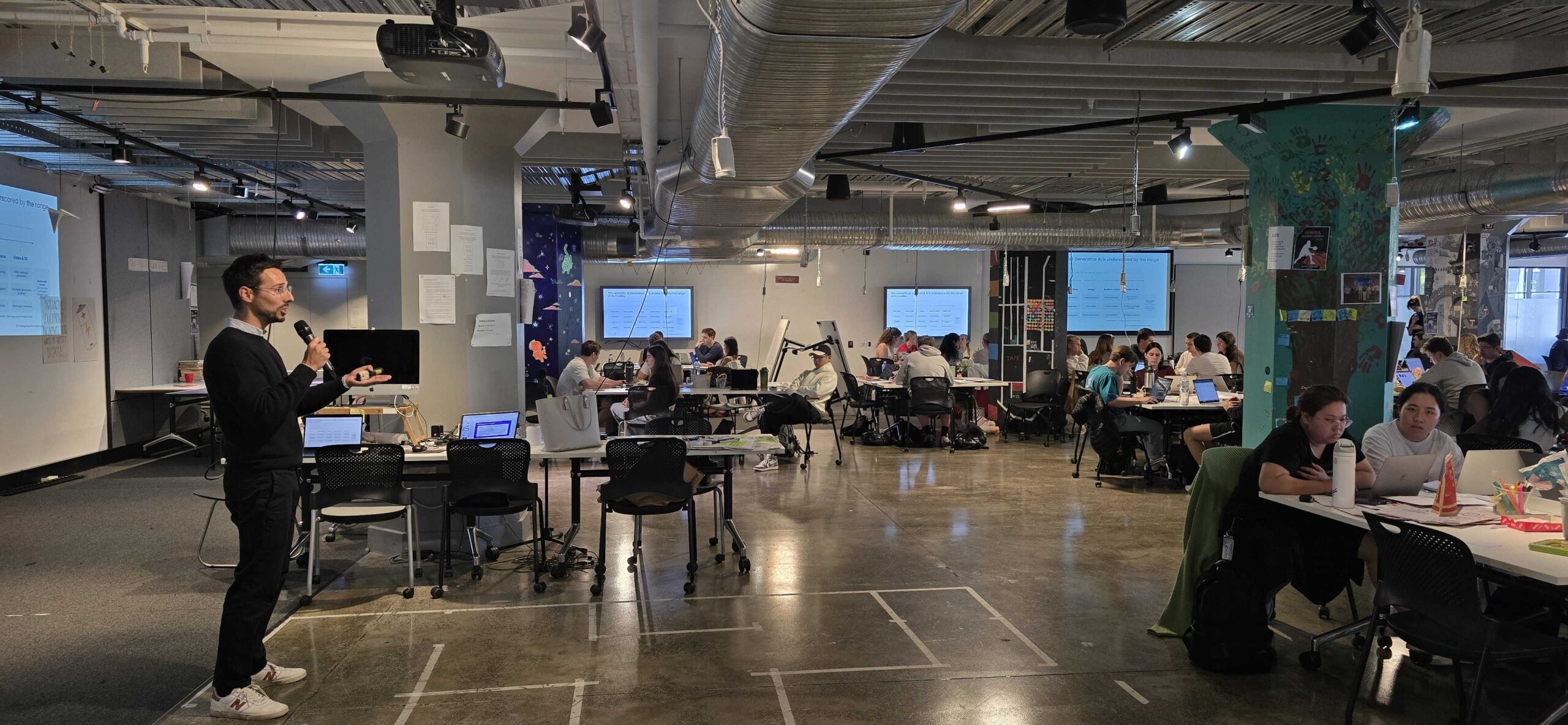

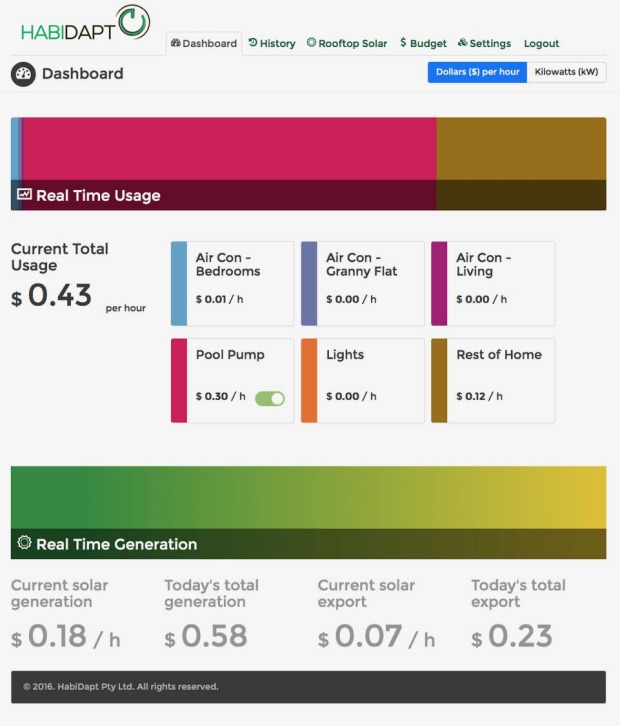

The Ergon-HabiDapt service, called HomeSmart, puts greater control and transparency in the hands of consumers

Retailers will need to dramatically re-imagine their business models and their value proposition to customers.

The most successful retailers will be those that understand their new role as both enablers of consumer-led electricity generation and management, and partners to customers who are now key players in the generation and trade of stored energy between homes, businesses, retailers and the grid.

The new dynamics at work in the energy sector spell industry-wide disruption, and demand aggressive business model innovation by retailers.

We’ve seen these changes coming for a long time, so why haven’t we seen earlier evidence of retailer innovation in product and service offerings to consumers?

Recent Australian Financial Review coverage of energy sector technology and business model innovations including the likes of Greensync, Mojo, Powerledger, Reposit Power and Redback threw light on the small, leading-edge innovators trying to garner traction in a market dominated by slow-moving incumbents.

Although Australian retail markets have become more competitive since 2010, according to the AEMC’s 2016 Competition Review, the competition is emerging from a very low base.

Australian electricity retailers to date have not played a proactive role in the adoption of new energy technologies such as rooftop solar, energy services or batteries.

This is because they are a threat. Innovative, tech-driven new energy players cannibalise the core business of incumbents – selling more electricity to customers.

Customer-centric changes

We’ve heard this story before and it doesn’t end well for reluctant, glacier-paced retailers. Spare a thought for the executives at Kodak who decided that embracing digital camera technology posed too great a threat to Kodak’s core business and its margins.

These dynamics are not unique to retail energy delivery. In most industries – banking and finance, law, telecommunications, insurance, retail – smaller, new market entrants that provide greater value to customers via leaner, more efficient technology-driven solutions, are eating increasing portions of incumbents’ lunch.

Disruptive start-ups achieve this by picking off a piece of the incumbent’s business model and redesigning it in a way that highly customer-centric. They give customers more of what they want and less of what they don’t. They deliver it in a way that is fast, digital and pain-free. And gradually they take market share away from incumbents.

To stay relevant, incumbent electricity retailers must partner with the new solution-providers.

Encouragingly, we’re now seeing an increasing number of partnerships between Australian retailers and emerging energy technology start-ups, including Brisbane-based Redback Technologies, which scored a $9.3 million investment from Energy Australia.

Redback’s Smart Hybrid Solar Inverter System integrates a solar inverter, solar battery, and cloud-based energy management software into a unit that can be mounted easily inside or outside the home.

Similarly, Ergon Energy’s partnership with Western Australian energy technology start up HabiDapt provides consumers with an integrated, digital energy management system to help households understand and manage their energy.

Energy partnership

The Ergon-HabiDapt service, called HomeSmart, puts greater control and transparency in the hands of consumers though; real-time monitoring and alerts, budgets and bill management services, rooftop solar services including system health checks and the ability to program appliances to respond to changing levels of solar generation and export.

The result? Consumers are empowered by knowledge and technology to manage and control their energy consumption, and Ergon creates new revenue streams for itself.

Importantly, this type of service is an evolution in the customer relationship – from that of supplier-consumer to an energy partner that supplies both energy, and energy services and technology.

These are the types of proactive retailer services that should be flooding the consumer market, but in reality they are few and far between.

As a consumer I’m yet to have been offered anything different by my retailer, nor seen any evidence that my retailer understands and is addressing pain points that I have with the current arrangement.

Thanks to the Grattan Institute Report “Price Shock: Is the retail electricity market failing consumers?”, released in March, much needed light has been shed on the on the astounding margins enjoyed by Australia’s top energy retailers while offering us little in the way of innovation in the delivery of their service.

The Uber approach

Where the Grattan Report took a misstep, however, was to conclude that the lack of innovation and competition in retail energy was linked to malaise and low engagement in the market by Australian consumers.

Grattan’s assumption is that consumer-led innovation means individual consumers are responsible for finding new solutions – banging down the doors of retailers demanding product and service innovations. That’s not how it works.

Consumer-led innovation means starting with the consumer’s needs and pains as the focal point of the retailers’ innovation effort.

It means retailers getting out of the building, sitting down with average customers to understand their world, and then designing products and services that meet their needs better.

Average taxi users didn’t go out and demand innovation from the market before Uber showed up, we just put up with a bad service because we couldn’t see any alternatives.

Uber worked out how to take away the pains experienced with the taxi service, and the onus is on our energy retailers to do the same.

Article first published in the Australian Financial Review on April 10 2017.