Banks are no longer afraid of other banks. They are afraid of new entrants into the financial services markets. Like Apple. Like Google. Like the supermarkets. And so they should be. Look at the potential disruptor – Apple Pay. Most of the financial service firms are racing to integrate Apple Pay. And as a consumer, if you have an established iTunes account, all you will need to do in the future to pay is use your phone as the payments device – and you are done!

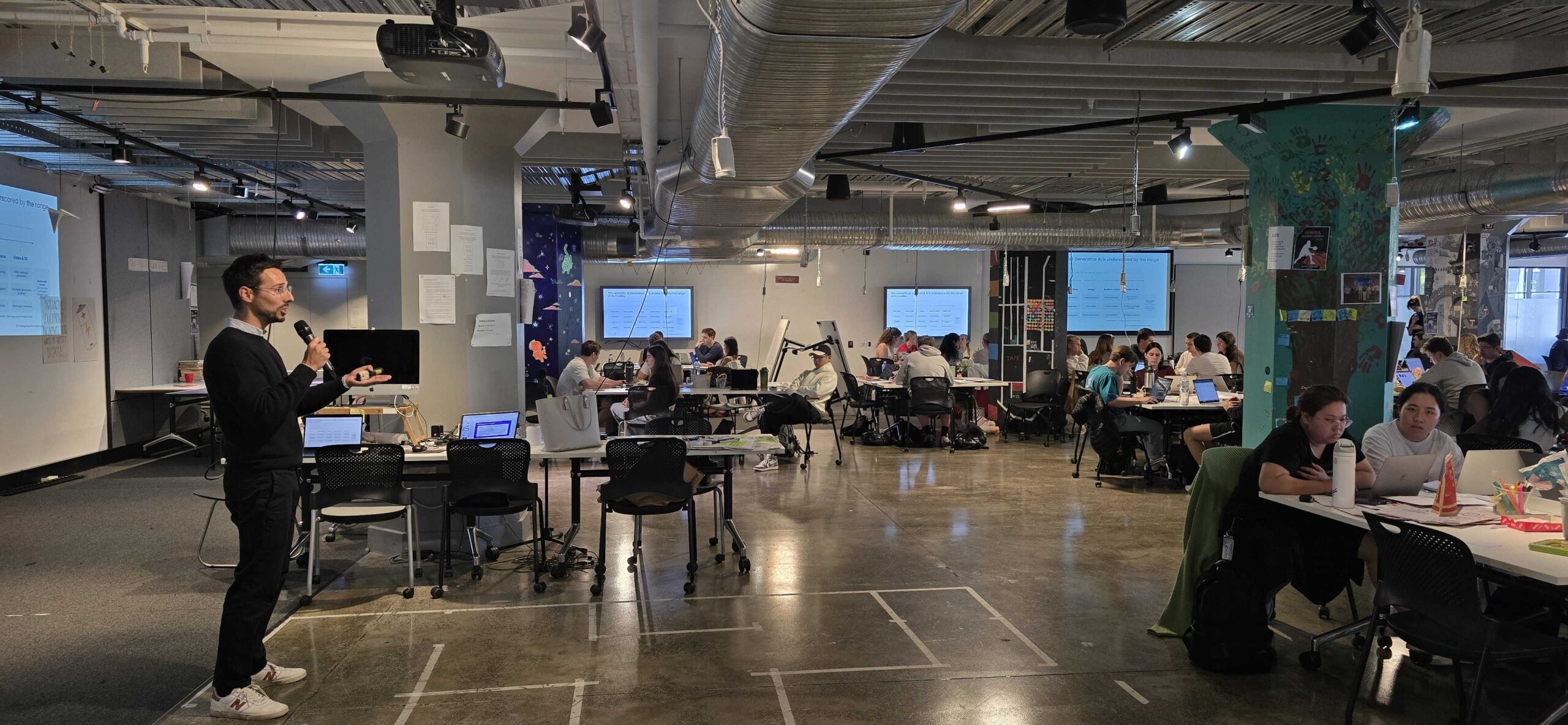

So it is interesting to see the increase that many banks are now putting in innovation. The Financial Brand recently ran an article on how banks are scurrying to increase their innovation capability. According to the 6th Annual Innovation in Retail Banking Study published by Efma and Infosys, 84 percent of banks globally are increasing their innovation investment in 2014 compared to 2013. As recently as 2009, only 13 percent of banks were increasing innovation investment.

More banks than ever also have an innovation strategy. In 2014, 61 percent of banks indicated they have an innovation strategy, a small increase from 2013, but a significant increase since the first survey in 2009.

Some of the other highlights of the study, as cited by The Financial Brand, include:

- Banks in developing markets are showing greater innovation ambition. Banks in emerging and fast growing countries (such as Brazil, India, Malaysia, Russia, South Africa and Turkey) are more likely on average to have an innovation strategy, to be aiming to become innovation leaders, and to be investing in R&D.

- The perceived threat from new entrants remains high. Tech companies like Google, Apple and Facebook are the greatest concern. After technology companies, the most significant perceived threat is from telcos and start-ups.

- Only half of banks are aiming to be innovation leaders. 49 percent of banks are aiming to be innovation leaders in their markets, whereas 38 percent of banks are content to be fast followers.

- Only a small minority of banks are investing in R&D. Most innovation in banking tends to be incremental with only 35 percent of banks investing in R&D type projects. For those unable to fund R&D, it is important to consider other ways to access potential developments.

- Channels continue to be the area attracting most investment. 89 percent of banks are increasing their investments in this area.

- Mobility is the most important innovation ‘theme’ for banks. 88 percent of banks rate the importance of mobility as ‘high’. Closely following that are the themes of ‘Big Data’ (67 percent) and ‘Social Channels’ (63 percent).

- A reluctance to “accept failure” is a cultural weakness which impacts innovation. There is plenty of anecdotal evidence that banks are not good at supporting employees who take calculated risks and fail, and the survey confirms that banks are weak in this area.

What is interesting is just how many banks today have an Innovation strategy. It is also no surprise to see where they see the threat coming from.

It will exceptionally interesting to see how this story unfolds in the future.