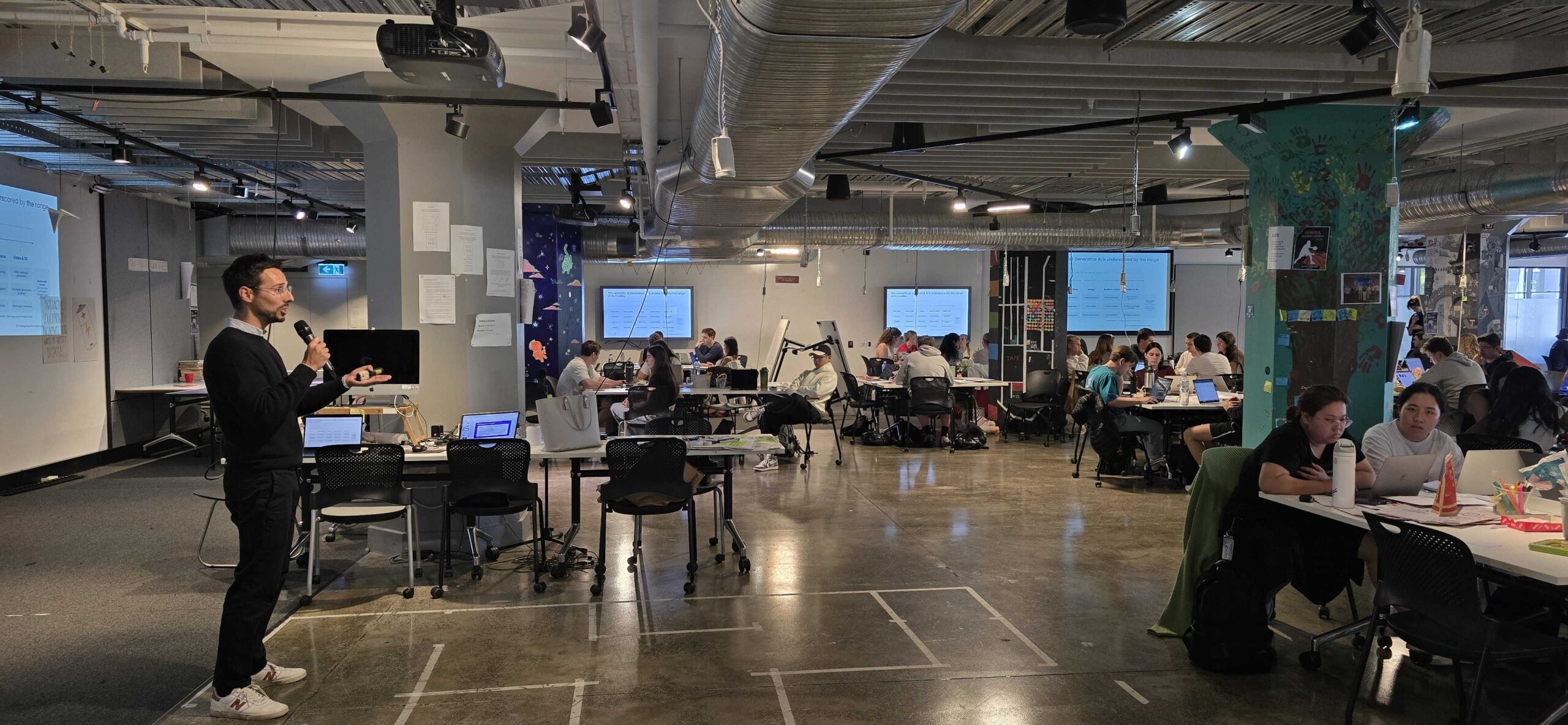

I recently attended ‘The Collective’ conference in New York run by CB Insights. The conference focused on two streams; innovation in all of its forms and Corporate Venture Capital (CVC). Similarly to one of my trips to Silicon Valley, a multitude of insights were uncovered and delved into throughout the conference. These insights may help transform large corporations and how they deal with start-ups and are especially useful for corporate investors with a CVC endeavour.

CB Insights is a global research organisation which focuses on business transformation and disruption. Several hundred large corporates attended the conference, the vast majority being US companies while myself and a few other individuals made up a very small group of Australian attendees.

The conference’s innovation stream consisted of ideas not outside of the usual; disruption, driving innovation within organisations, fostering an innovative organisational culture, innovation leadership, responding to external industry competitors and digital transformation in terms of data use and the place of Artificial Intelligence in society today.

However, the stream that sparked the most interesting insights for me was the conference’s CVC stream. Here, many conversations were had regarding how corporates should select investee companies and how to remain connected to these companies, the challenges associated with expecting instant success once funding is received, as well as highlighting what is working and what needs to be changed in the world of CVC.

Additionally, two clear points were made: not only is CVC a competitive market to engage in, but it is a long-term commitment which not many corporate organisations are aware of prior to entering the CVC space. These two factors associated with CVC pose the question of how to bring in new opportunities to the core investor business successfully and whether this is even possible. Many CVCs tend to fall apart due to the polar opposite values possessed by smaller start-ups and larger corporations. An example of a successful separate CVC business is Samsung’s ‘Samsung Catalyst Fund’ which is located in Silicon Valley in order to be closely connected to their start-ups of interest.

With all of this in mind, here are the five key insights that I gathered from the conference:

1. CVC is still in its infancy

While it is easy for large corporates to throw money at CVC, the mindsets of start-ups in conjunction with large organisations are like oil and water. More often than not, corporates expect that the simple allocation of funds will generate results from the CVC. However, carving out the money for the endeavour is just the start of the journey. Furthermore, there is often the expectation from start-ups that huge networking opportunities will come from the corporates throughout the CVC journey. It is important to note that this does not usually happen. Overall, there is often a significant mismatch of expectations amongst the corporates and start-ups – many left unsaid – that pollutes the opportunity for success as time goes on.

2. Separate the venture from the mothership

It is highly necessary that corporates recognise the need to separate out the venture arm from the corporate mothership. Additionally, not only should the corporate embrace the start-up’s culture, but it should also want the venture to think and act differently. Differences in culture, ways of working, managing teams, timeframes and costs should be welcomed and somewhat adopted into the corporate environment.

3. When success happens

At the time money is allocated within the venture, a large focus should be on how to realise value once it has proven its success. If this is not done, the corporate investor company runs the risk of ultimately gaining nothing at all from this CVC. Additionally, in this ever-changing world, corporates should nurture and adopt the disruptive opportunities and business models coming from the start-up that may, in time, replace the core of the corporate’s current business model. Contrastingly, many CVC endeavours take place with a view of ultimately folding the venture back into the mothership. In our view, this is wrong.

4. CVC is not the same as M&A

Corporates need to realise that CVC is the not the same as Mergers & Acquisition (M&A) in the sense that corporate investors are not the owners of the investee companies. If this is the type of mindset that is to be adopted throughout the CVC endeavour, corporates are ultimately setting themselves up for failure. In M&A, the traditional thinking is to strip out costs and merge the entities under a single or separate brand. Alternatively, in a CVC, the organisation is looking to grow the venture as a separate entity so the mothership in time can significantly benefit from the learnings of the separate venture, both in terms of culture but also around the development of totally separate business models.

5. There is no room for short-termism

It is vital that there be a clear definition of the horizons in which CVC will play a role in a corporate company’s agenda. The prominence of short-termism amongst corporate investors throughout the duration of CVC endeavours is a hefty issue for listed corporations today. It is crucial that investor organisations view CVC as a long-term growth prospect for their company while also making a long-term commitment to setting up a corporate venture fund that may only return value in 5-7 years.