In the wake of the 2008-2009 financial crisis, Citi embarked on a strategy to return to its heritage as an innovator in financial services.

Over its 200 year history, Citi had established a long history as an innovator in global banking, from funding the transatlantic cable to establishing the first Foreign Exchange Network to pioneering ATMs.

But senior leadership acknowledged that the company had lost its footing in the years leading up to 2008 as it focused more on growth through mergers and acquisitions. “We’ve lost innovation,” one senior executive concluded. To that, Citi’s CEO replied, “Get it back!”

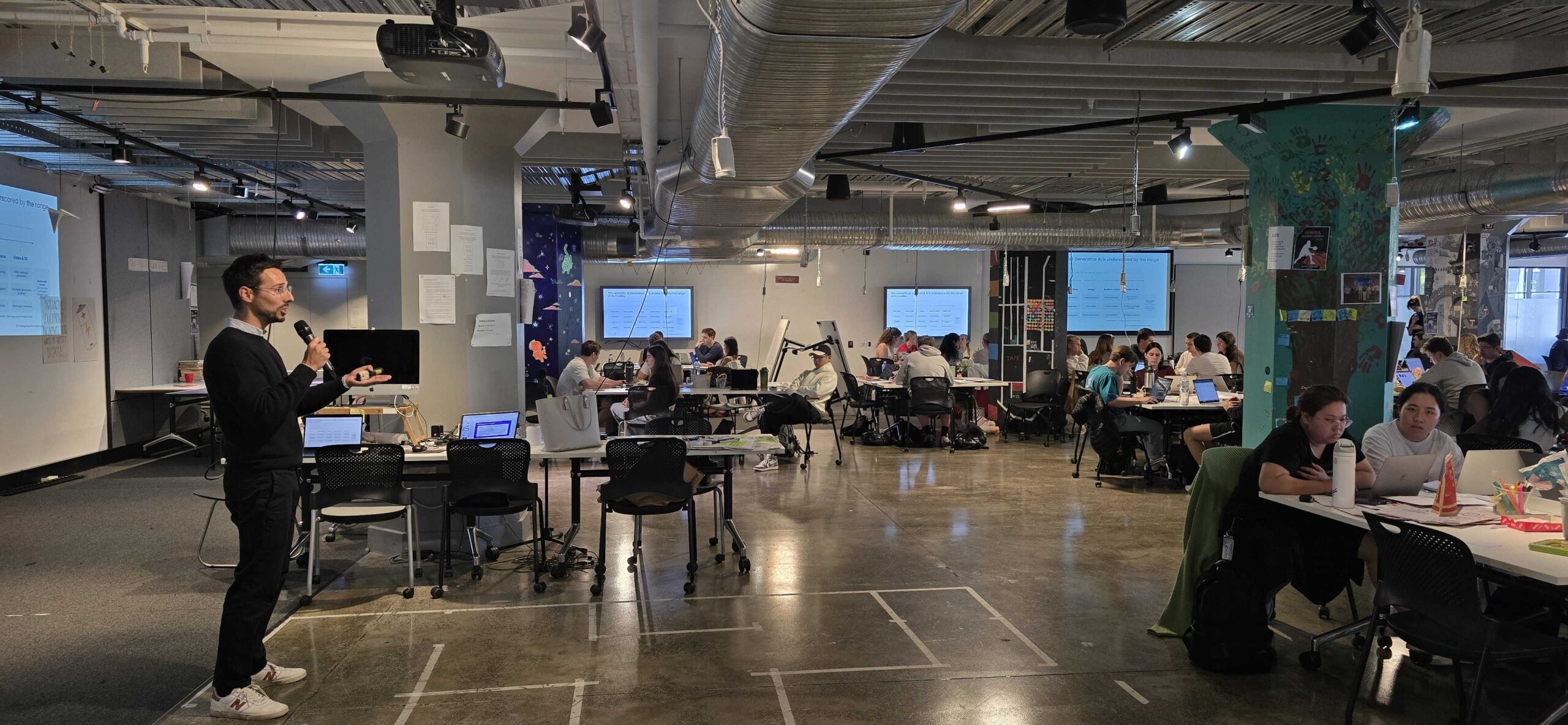

By the end of 2009, Citi was focused on rebuilding its innovation capabilities in a deliberate way. And it engaged Innosight to help design and implement a custom version of the “growth factory” system that had been successful at Procter & Gamble in the early 2000s.

A new portfolio approach to innovation

Led by Citi’s Chief Innovation Officer Deborah Hopkins, the team identified six areas of innovation that would be critical to the future of finance: data monetization, big data, mobility, security & authentication, emerging IT, and next-generation banking and financial services.

Citi began by reaching out across the organization to crowdsource thousands of ideas for improving the customer experience and growing the company. Then it prioritized the most promising projects and instituted new governance structures to allocate resources and manage change. The team organized those high-potential initiatives into three portfolios that would yield different kinds of growth:

- Core innovation – improvements to existing offerings in existing markets using proven business models. For example, the “Citi for Cities” initiative was created to apply current systems to help make cities and governments thrive – by improving service levels, efficiency, and security. The projects ranged from introducing a smart-card transit system in Singapore to funding small manufacturing in San Francisco to launching new interactive services in Mumbai.

- Adjacent innovation – “new to Citi” innovations that either extend existing products to new markets or leverage existing Citi capabilities, assets, or relationships. For example, in 2011, Citi launched ” Citi Velocity,” an online information channel that allows traders and clients to have instant access to Citi research and real-time market information.

- Disruptive innovation – “new to the world” innovations that reframe markets and create new ones. For example, Citi Ventures, the bank’s corporate venturing arm, partnered with Jumio, a Silicon Valley start-up that harnesses cameras in any mobile phone, tablet, or laptop to increase the security of remote payments.

You can read the full article here