Infosys Ltd is trying to improve the effectiveness of its sales team by incorporating elements of design thinking, among other measures, while making pitches to prospective clients in an effort to win more orders that exceed $100 million in annual revenue.

LiveMint reports that CEO Vishal Sikka has, however, told top company executives that any “meaningful impact” of all the current measures, including using Design Thinking and automation on how Infosys writes code and rolls out technology solutions for its clients, will start reflecting in its earnings only from the October-December quarter.

Design Thinking is generally understood to involve a creative and systematic approach to problem-solving by placing the user at the centre of the experience.

“The focus now is clearly on how to win more $100 million plus deals… account hunting (winning new clients) and account mining (generating more business from existing clients),” said an executive who did not want to be named as he is not authorized to speak to reporters. “(And) this can be done only if we are able to tell clients what benefits we bring.”

Sikka, the first non-founder CEO of India’s second biggest software services company, has set an ambitious target of more than doubling Infosys’s sales to $20 billion by 2020.

To achieve this goal, Sikka has embarked on a strategy to increase automation and apply new technologies such as artificial intelligence, increase the company’s investments in start-ups and arm employees with skills such as Design Thinking to meet clients’ needs and boost sales.

Still, Infosys earnings missed analysts’ estimates in the March quarter for the first time since Sikka took charge in August, illustrating the challenges involved in meeting the company’s 2020 goal.

More worryingly, the company missed its earlier forecast of expanding revenue by 7% in 2014-15. It generated incremental revenue of $462 million in the financial year, compared to $463.7 million by Wipro Ltd and $2 billion by Tata Consultancy Services Ltd (TCS), the country’s largest software services company.

Of late, Infosys has lost out on some big deals, including to Accenture Plc, which won a $100 million plus outsourcing contract from mining giant Rio Tinto Ltd this year, making Sikka and his team conclude that Infosys hadn’t been able to effectively communicate to customers the transformation benefits it can offer customers.

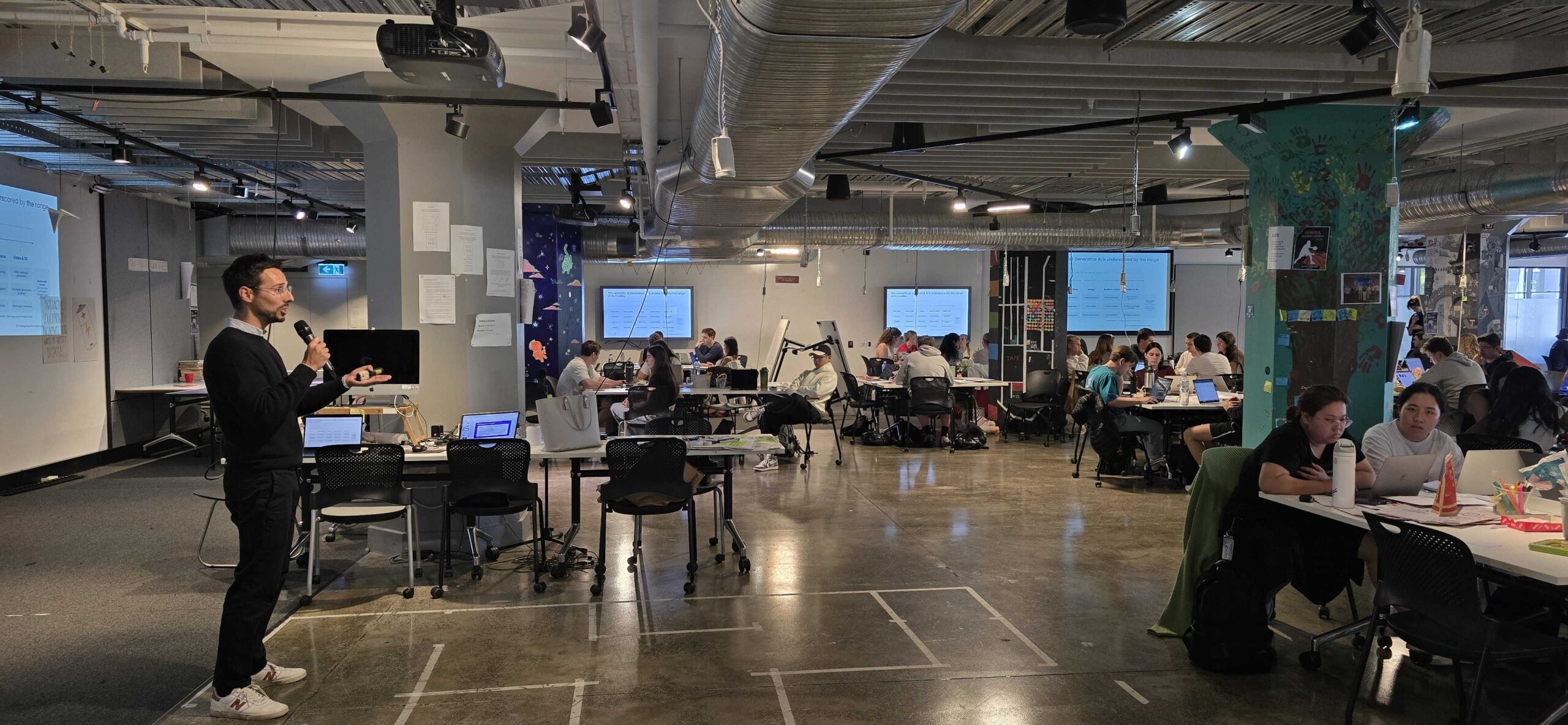

For now, Infosys has 19 customers that each generate more than $100 million a year, more than Wipro’s 11 such customers, but lower than Mumbai-based TCS’s 29. Under the company’s latest initiative, a handful of key account managers and the five vertical heads, including bosses of banking and financial services and retail and manufacturing, have started engagements with senior executives at some of the largest companies that are expected to outsource large information technology work in the coming months. These executives have undergone training in design thinking. Infosys said more than 25,000 engineers, including about 80% of its 1,700 sales executives, have completed classes in design thinking.

“IT spending worldwide is being cut… so our conversations are on how can we offer transformative deals… say how can we better a firm’s supply-chain capabilities… now everyone (IT vendors globally) promises benefits, but design thinking helps us as the way we approach it is to keep customer at the centre and then approach (offer)… solutions to their problems,” said a second Infosys executive, who also requested anonymity.

On generating more business from existing customers, Infosys has also started having design thinking classes with 20 of its customers in the hope that it addresses some of its clients’ problems. Later, the company’s sales team could make specific proposals.

“You can change the RFP (request for proposal) process by being more proactive and using a design-thinking session to address all the issues upfront and then provide a proposal,” said Ray Wang, founder of Constellation Research, a technology research and advisory firm.

Clients publish an RFP, detailing the work and financial parameters of the deal, before awarding a contract.

However, some experts believe the company’s push to win mega deals using design thinking will take time before it produces results. “I think the strategy of reinventing RFPs to win more deals will require much more investment and new skill sets—which are a multiple year journey to build,” said Rod Bourgeois, founder and head of research at US-based DeepDive Equity Research, a tech stock research company. “So, even though I think this particular approach to RFPs is an appropriate strategy to pursue, it should entail added costs in upcoming periods, and investors should not expect quick revenue benefits from this approach.”

Starting April, Infosys’s five vertical heads, including Mohit Joshi, Head of Banking and Financial Services which accounts for over a quarter of Infosys’ $8.7 billion revenue, have been reporting directly to Sikka. Further, the performance of the vertical heads will be evaluated on revenue growth and pricing, according to the second executive, unlike in the past, when performance was evaluated based on the individual sector’s profitability. Finally, Infosys has also roped in professional services firms to help its sales executives in improving “proposal writing”.

The Bengaluru-based software services exporter, which ramped up its sales team to 1,700 from 1,300 people in the last nine months, expects these measures to help it improve its deal pipeline. In the January-March period, according to the executives cited above, “new deal closures was weak”.

Some experts say that Infosys acknowledging problems of account hunting and account mining could be symptomatic of a deeper problem and could mean a “long drawn-out turnaround”.

“(Until now), we heard only T.K. (T.K. Kurien, CEO of Wipro) flagging account mining issues. To hear Infosys talk in the same words, it could be symptomatic of a deeper problem as the cost optimization thing was a low-hanging fruit which they seem to have done well. The problem will be how they get more new clients and more business (from existing clients),” said a Singapore-based analyst who declined to be identified.

Sikka, has been aggressive in acquiring firms—Infosys has spent $320 million in buying automation technology provider Panaya and digital commerce firm Skava since he took over in August—but Infosys has seen a decline in winning traditional outsourcing work, including deals in business process operations and infrastructure management, which come with lower margins for IT vendors.

“You have to give time for these (next-generation) measures to reflect… at least another three-four quarters before any meaningful impact can be seen,” said the first executive.