Who would have thought that banks – old, conservative organisations that deal (well, dealt) in cash and gold and pieces of paper – would become the leaders in disruption and innovative thinking? Well, many of them are. It was interesting to read the Australian Financial Review article on how many of our Australian banks are leading the way in the use of Design Thinking, while many corporates in other industries are still lagging. Here is our take on this:

- Banks realised not all that long ago, from the Board down, that to be different from competitors, banking is largely not amount money – it is about the banking experience. And while business and organisations might seem like banking customers, there are people in those organisations – and it is people who make decisions on which bank to use – hence we come back to the experience.

- Banks realised that they had to develop “attitudinal loyalty” – stickiness not only around the difficulty of moving from one bank to another, but loyalty that would prevent offers and marketing to entice a customer to shift. Apple does this exceptionally well. It has products that are twice or three time the cost of the competition, but it has built a customer base that is attitudinally loyal.

- Banks at their heart know they are being disrupted. Many other organisations talk about a moat round them preventing disruption. At their peril. Banks know that the Googles, Apples and Facebooks of today all have financial services in their sites. These are the major competitors they face today, and they need to do something – and quickly!

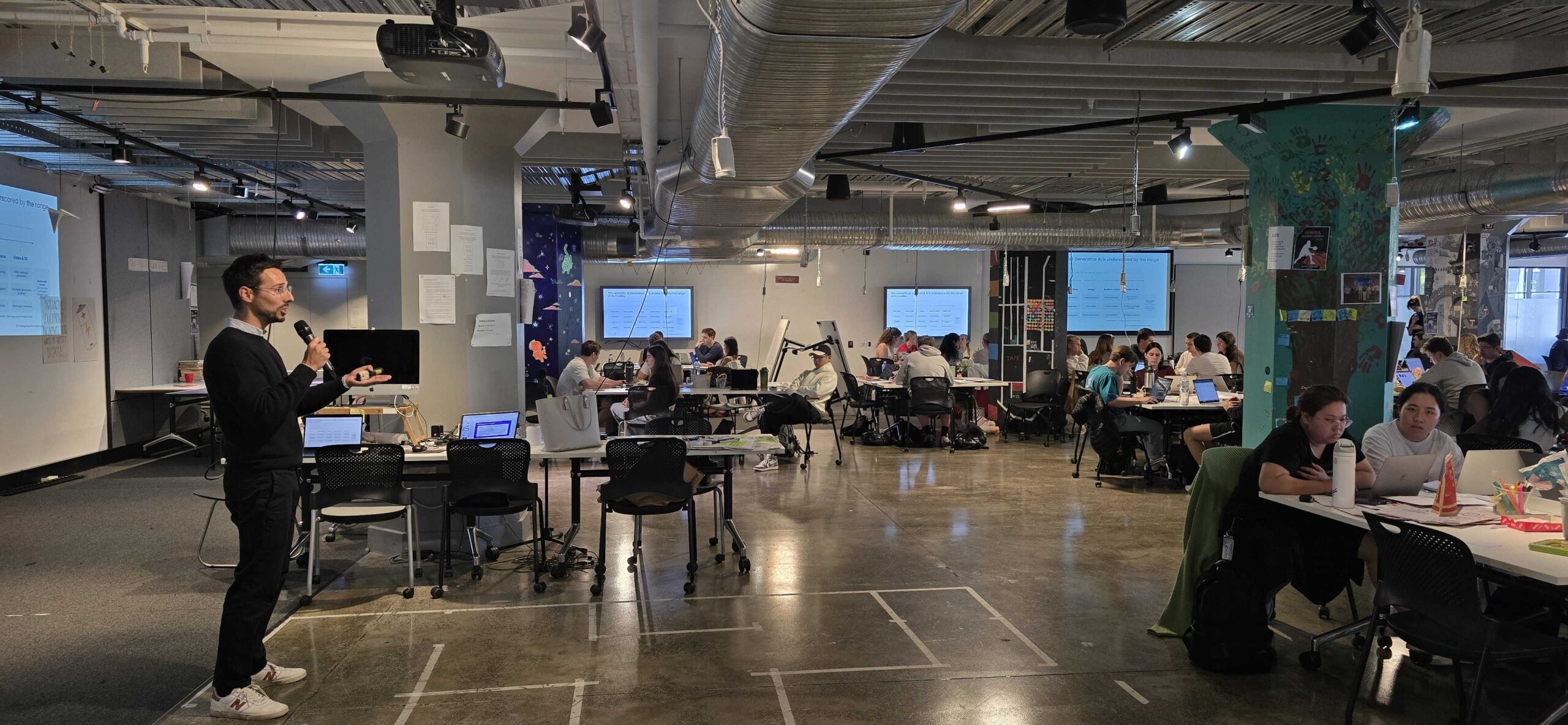

- Just talking about being “customer centric” just doesn’t cut it. Every organisation talks about their focus on the customer – few execute. And the reason is that they need a process – this is where Design Thinking comes in. It is a well designed, tried and tested process that at The Strategy Group we work with many of our clients to build design and customer empathy at the heart of the organisation, not at the edge.

CBA’s executive General Manager of digital channels, Lisa Frazier, told delegates at a recent Agile computing conference in Sydney, that she had to push changes to the way in which development funding has historically been allocated to make the way for Agile projects, which also require iteration and experimentation. More than 3,500 CBA staff in IT and operations have undertaken formal design thinking training and the bank is rolling this out to other areas.

What is your organisation doing about truly empathising with your customer? Are people in the banking world really that much safter than you?

Think about it.